This week’s note on Smart Eye (SEYE) from a Redeye analyst was disappointing and, quite frankly, unfair to investors who mistakenly believe it’s the leader in driver monitoring (or, as it might now term it, ‘interior sensing’). It isn’t.

Perhaps desperation at the fall in Smart Eye’s share price following the Volkswagen (VW) win by Seeing Machines has prompted this latest attempt to maintain the myth that Smart Eye is the market leader. However, any sober analysis leads one to question this.

Smart Eye’s recent moves on the acquisition front are evidence for me of its late realisation that it can’t compete on the DMS/OMS front with Seeing Machines, proven by its recent failure to win VW.

Furthermore, I think SEYE has overstated the value of its wins to date, while Seeing Machines has understated its own 8 OEM wins. For example, One of Smart Eye’s early wins was with BMW, but it has since been supplanted by Seeing Machines. VW and Mercedes have also gone with Seeing Machines. Do you see a pattern?

In the US, General Motors, Ford and FCA (now part of Stellantis) chose Seeing Machines. Similarly, Fisker and Byton chose Seeing Machines.

The much-vaunted early Audi design wins back in 2017 by SmartEye have also failed to go fully into production, as has the Jaguar Land Rover win a few years back. Redeye naively assumes that they have been temporarily postponed. As the analyst states on page 5 of this note published on 9th May, 2021: “Smart Eye says it has still not lost any design wins, but some are postponed for external reasons.” Let me suggest that those wins have been lost, as the auto companies concerned realise Seeing Machines’ technology is more advanced.

Importantly, the VW and Fisker wins indicate that Seeing Machines is not only the leader in DMS but is also winning as car manufacturers seek to build in occupant monitoring systems and move to interior sensing. Yes, Smart Eye can talk the talk re. Occupant Monitoring but the only cars currently going into production with OMS have a Seeing Machines system.

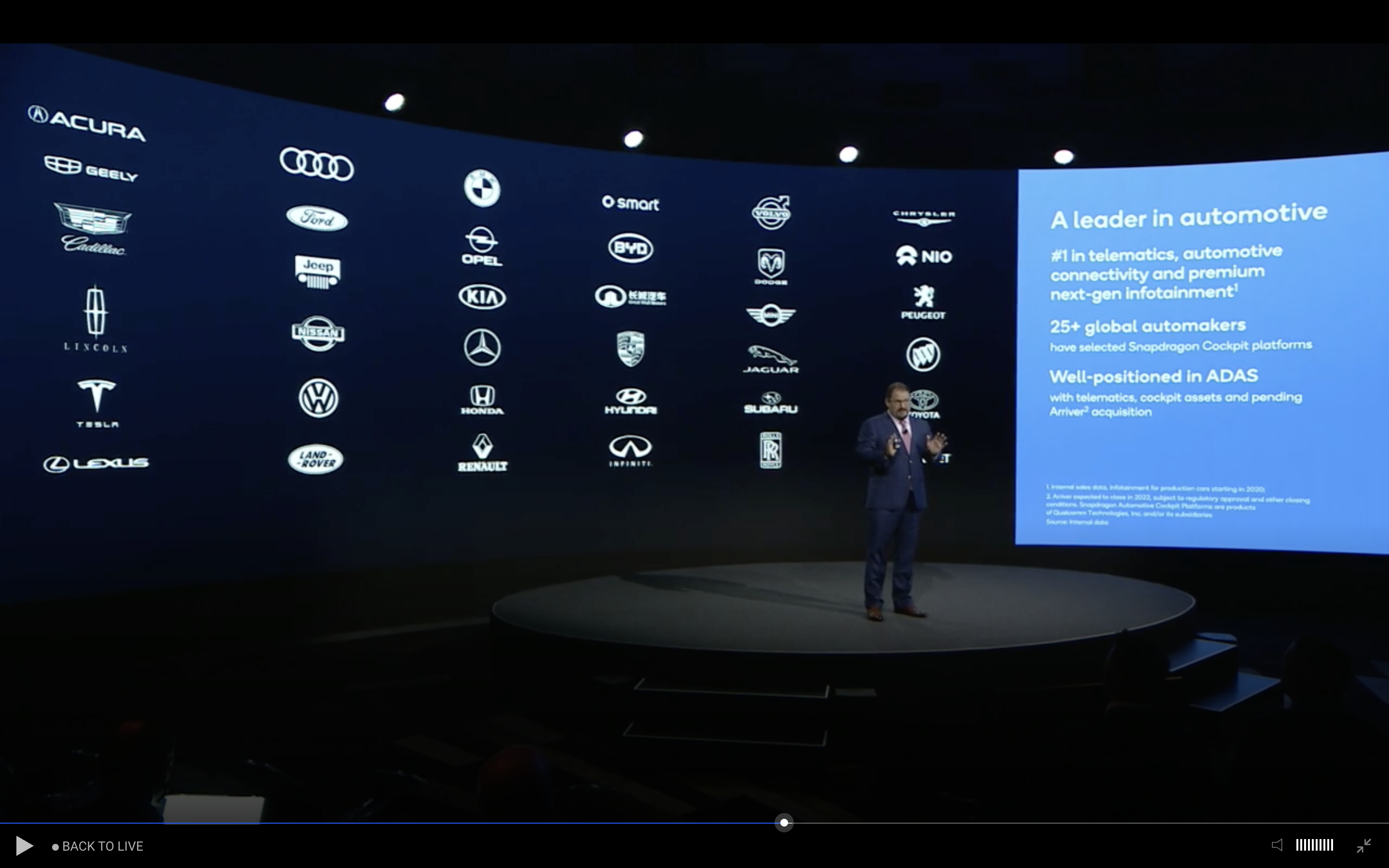

A further indication of SEE’s leadership position is evident from the fact that Qualcomm chose to partner only with Seeing Machines. Similarly, Magna has chosen to use Seeing Machines technology.

My research indicates that Smart Eye’s “pure software” model effectively means that it is treated like a commodity and doesn’t really gain the respect of the Tier 1s whereas, in sharp contrast, Seeing Machines is acknowledged as the expert in DMS/OMS. After all, OMS is effectively only DMS with more occupants. And Seeing Machines leads the way in DMS.

What that means is that OEMs are far less likely to take a chance on Smart Eye for big programmes delivered to short timescales, especially when high-level DMS will be make or break in achieving 5 star NCAP ratings from 2024. It is simply too important for them in a fiercely competitive market to take a chance. For example, imagine the pain that Renault recently experienced at the hands of Euro NCAP, receiving 0 stars for shoddy safety in its Zoe. Such an event must be concentrating minds at car manufacturers around the world.

That’s why I think Seeing Machines is going to clean up in the DMS/OMS market. Okay, Smart Eye will win a few Chinese models and low volume models elsewhere but for premium and large volume RFQs I don’t expect it to win any of note.

A further problem for Smart Eye may also be that QC is set to take away its Chinese lunch in due course, supplying Seeing Machines technology as part of its system.

Of course, I may be wrong or, perhaps, my investing in Seeing Machines has affected my judgement.

Well, here’s a little test. Back on 22nd October, 2021 the Redeye analyst wrote: “Three of the largest DMS procurements to date will be completed within next few quarters – where ‘Smart Eye is a force to be reckoned with in all three’. Though we don’t know what this means, we believe Smart Eye is confident of getting at least one or two of these”.

Well, one of them has been completed and it wasn’t Smart Eye that won it. I’m confident that Seeing Machines will win those other two in this financial year, as well as a host of others this year and next.

Fleet

I’m expecting great things from Seeing Machines’ Max Verberne and his team in fleet, similar to what Nick DiFiore and his team have achieved in auto.

I’m therefore confident that 2022 is set to be a transformational year in fleet for Seeing Machines. Despite the fact it already has approximately 32,000 fleet installations, the pipeline is rapidly expanding, 40% annual growth in revenues is expected. The Shell deal is huge and offers the potential for many thousands of installations each year, National Express is also in the process of rolling out Guardian tech to its enlarged fleet following the acquisition of Stagecoach. That target market represents approximately 40,000 badged as National Express, with approximately 10,000 more belonging to contractors.

Moreover, such is the potential for driver monitoring as part of an overall control system that it is clear this is only the beginning of a global ramp up in sales. Seeing Machines is only scratching the surface of the potential within telematics with its current partnerships. Europe and the US will be screaming out for this technology as regulations tighten and companies seek to improve both safety and reduce emissions. This will all become apparent as we hear more about the introduction of its 3rd Generation fleet product.

In contrast, SmartEye is ‘pre-revenue’ with a fleet operation that only launched in March 2021, with 20 staff. It had a ‘pilot projects’ operational in July and I look forward to hearing about some meaningful revenues one day soon.

Aviation

Smart Eye is even further behind in aviation. To the extent that even Redeye doesn’t want to talk about it. Suffice to say that it has yet to fly in Aviation.

By comparison, Seeing Machines’ Pat Nolan is airborne, and charting a course for a smooth landing on profit central. Take, for example, the recent agreement with Collins Aerospace, which is the world’s largest Tier 1 avionics company.

In addition, via CAE and L3 Harris, Seeing tech is already in simulators used by Quantas and the Royal Australian Air Force. It is also working with Airservices Australia to use its technology within Air Traffic Control (ATC).

Summary

In summary, not only does Seeing Machines lead in auto, it is far ahead of any competitor in fleet and the only player in aviation. Too little, too late, sums up Smart Eye’s offering in both fleet and aviation.

I expect the next second half of this financial year to confirm the pre-eminence of Seeing Machines in all three transport sectors. Seeing Machines’ ever-growing pipeline will make this very clear, very soon.

Yes, Smart Eye does have significant value and potential. However, in my humble opinion, it could be an expensive mistake for an investor to presume it is in the same league as Seeing Machines. Of course, any investor should do their own research.

Full-year results for both companies should bear out what I have stated here. In the end, the acid test for both is the visibility of increasing revenues and profitability. If I am correct, Seeing Machines should impress on the upside and Smart Eye will fail to match that.

The writer holds stock in Seeing Machines.