Last week Seeing Machines threw down the gauntlet to would-be competitors and those hoping to acquire it on the cheap. Broker Cenkos responded by raising its price target to 19.5p.

At its full-year results presentation on Wednesday, it reaffirmed solid progress over the past year. This followed news earlier that week of a US$41m ‘strategic’ fundraise. The money raised will finance costly R&D efforts as it seeks to capture 75% plus of the global driver monitoring market, increase it share of the trucking market and expand further into aviation.

In a pretty frank presentation CEO Paul McGlone made it pretty clear that Seeing Machines intends to grab a dominant market share in auto over the next 6 months before any move to seek a dual Nasdaq listing. My reading is that Qualcomm now needs to open its wallet wider than it has ever done to acquire Seeing Machines.

Risk of cheap bid is over

Let me say that again. The risk of a cheap bid is over. US funds coming in at 11p aren’t doing so to make a measly 5x their money. In my estimation, as the market wises up to Seeing Machines taking over 75 percent of the global DMS market, anything below £1 a share is not going to secure Seeing Machines.

As proof of that is the news that Mirametrix, which uses AI for computer vision applications, was reportedly sold for a huge multiple. Seeing Machines is, in my opinion, worth far more.

The recent A$140m contract with Tier 1 Magna (which also invested £10m in Seeing Machines) should serve as a wake-up call to investors and rivals alike. There will be plenty more wins over the next few months.

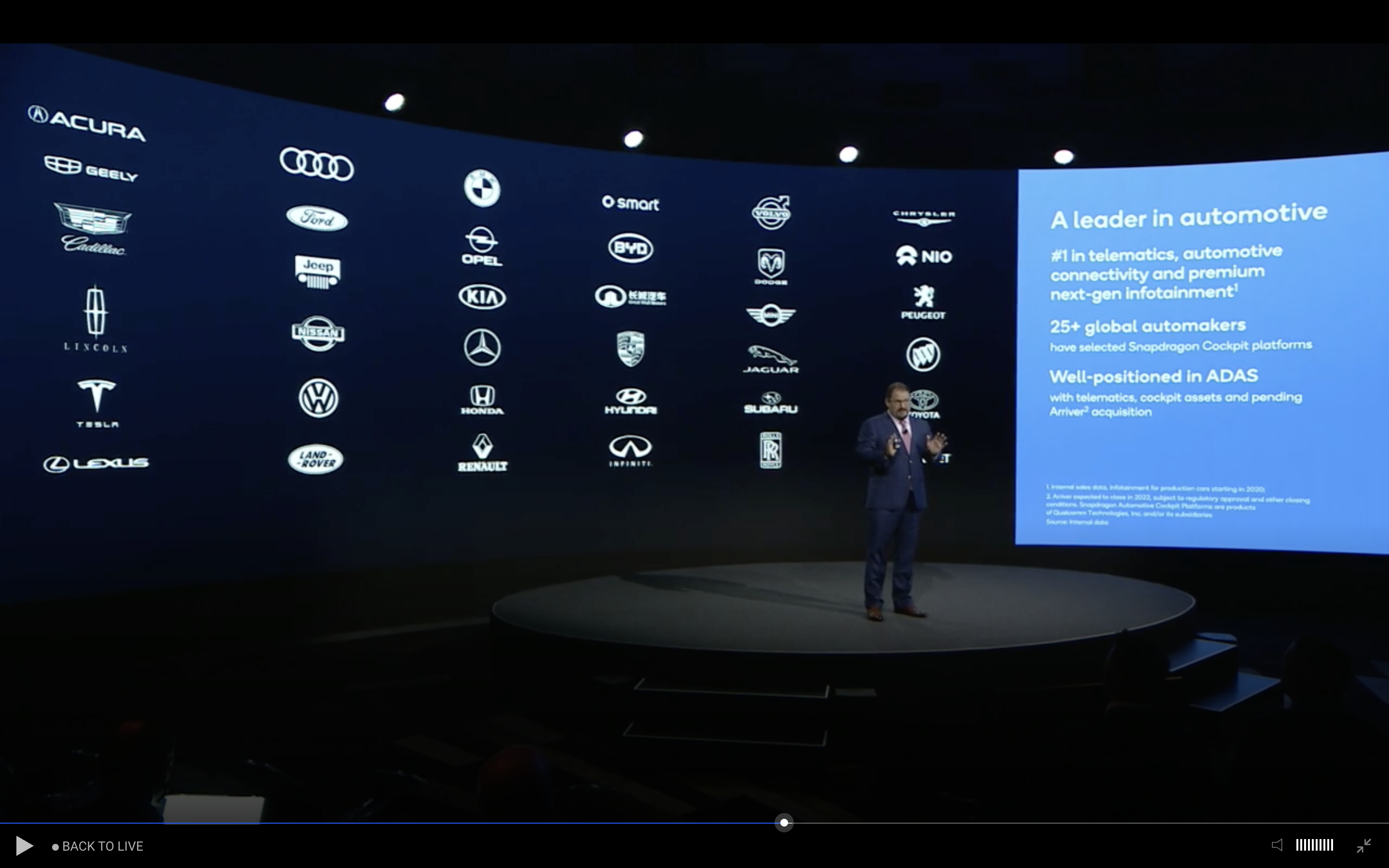

My central thesis; that SEE win Toyota, Honda, VW (including Audi), Volvo, Jaguar Land Rover, Stellantis and Tesla in addition to BMW, Mercedes, Ford, GM, Byton and Fisker remains very much intact. Why? Because as far as driver/occupant monitoring goes, Seeing Machines is pretty much the only game in town.

Sadly for investors, these contracts take time to officially sign and partners are, for a variety of reasons, not keen to provide too many details. Yet, growing auto revenues from license fees tell its own story. They are projected to keep on growing as the company wins more and more business. By the end of this financial year, we’ve been promised much greater clarity on an auto pipeline that I expect will be worth a billion Australian dollars.

In the meantime, with Covid concerns growing alongside the realisation that the global economy isn’t recovering as it should, there will be ups and downs in the share price. Still, the direction of the business is clear: it is taking over global DMS.

Of course, I fully expect Seeing Machines to continue to downplay the potential size of contract wins, even as it announces them. For as Cenkos analyst John-Marc Bunce confirmed in his note of 24th November: “Seeing Machines has been underplaying the value of its RFQ wins and relationships to increase its chance of winning more business.”

Even so, after the penny drops in automotive, I expect a bidding war will materialise — though Qualcomm is currently the hot favourite to win it.

Show me the money Qualcomm!

I don’t know when Qualcomm will bid for Seeing Machines but I doubt it will wait until the success of Seeing Machines is public knowledge. At the moment it has a slight edge, not to mention a huge wallet, but the fact that Magna is making subtle overtures must be unsettling.

Maybe I’ve had a little too much port, but the present scenario is reminiscent of a scene from the film Jerry Maguire, with Qualcomm’s Christiano Amon required to scream: “Show me the money!” As Paul McGlone dances. If Qualcomm fails to do that, I know a few other companies that will.

Meanwhile, in the absence of any ‘reasonable bid’ investors will have to be patient. For newbies that is a lot easier to do than for long-term investors but progress has clearly been demonstrated. Fleet is growing at approximately 40% a year, SEE is winning auto business and its penetration into aviation is growing.

Admittedly, the fine detail on many issues is still scant, and there are always execution risks, but what isn’t in doubt is that Seeing Machines technology is going to dominate this market over the next few years. There was enough in the presentation to give valuable insights into its business but insufficient detail for those seeking easy ways to value the company in the very short term.

While Cenkos has immediately raised its price target to 19.5p, Stifel has yet to issue a note. Is it saving a note for some big news prior to Christmas?

Costly R&D

Unfortunately, continued costly R&D is unavoidable as Seeing Machines is being pushed to deliver up to 40 additional features alongside its core technology (everything from being able to tell if a driver is using their phone to identifying the ID of the driver) to win the A$1.1 billon in contracts currently up for grabs. Fortunately, Paul McGlone has said that the company will attempt to license such technology where possible and eschew rash and costly takeovers. Thankfully, no competitor is anywhere close to being able to deliver a comparable system to the timescales required by auto manufacturers — timescales driven by legislation in Europe and the US.

In addition, SEE should be able to charge increased rates for some of these features. Cenkos estimates an average selling price (ASP) of US$14 a car recently, an increase on its previous estimates, and it is hoped this trend may continue given SEE’s domination of the market. Like Qualcomm, but on a smaller scale, it is selling a highly complex system not a single product to a market desperate for its cutting-edge, DMS technology.

Despite serious pressure to cut costs in automotive, there appears to be no other DMS company that can really deliver to the specs demanded by car manufacturers in the short time frames and price points at which they want it. Thus, I expect Seeing Machines to be well on it way to winning 75% plus of the global DMS market by 2025, increasing profit margins as it does so.

Similarly, it is working on the 3rd generation of its Guardian aftermarket product for trucks – while at the same time starting to go into trucks at the manufacturing stage. We await a contract announcement regarding that in due course.

Investors are still waiting for a Caterpillar-style license deal for aviation with L3Harris. While we wait for it to materialise, there appears plenty of upside from the current share price of around 10p-11p. With significant news expected at CES in early January, only a market crash is likely to prevent the current share price from rising substantially over the next few months.

The writer holds stock in Seeing Machines.