Can I be the only person who thinks the state-encouraged Coronavirus panic is overdone to an absurd degree?

Before you label me a ‘nut job’, deep clean your computer and order a few more face masks, please hear me out.

I admit Coronavirus exists. I admit it is fairly virulent and does kill people just as flu does. However, it is not nearly as deadly as the ebola virus. According to the World Health Organisation (WHO) the average ebola virus disease case mortality rate is around 50%. Case fatality rates have varied from 25% to 90% in past outbreaks.

With Corona virus the mortality rate is only around 1%. It does not appear to kill people who aren’t already suffering from underlying health conditions. Generally, people who are older than 60, or have a weakened immune system or chronic illnesses like lung disease, heart disease or diabetes, have the highest risk of becoming severely ill if they contract the coronavirus or the flu.

Flu kills more

One crucial fact should not be forgotten; the numbers who are dying from it appear to be far less than die from seasonal flu each year.

According to the WHO across the globe up to 650,000 people die from respiratory diseases linked to seasonal flu each year. So far, approximately 178,000 have died from Coronavirus worldwide. (While every death is regrettable we need to keep a sense of proportion).

Public Health England estimates that on average 17,000 people have died from the flu in England annually between 2014/15 and 2018/19. However, the yearly deaths vary widely, from a high of 28,330 in 2014/15 to a low of 1,692 in 2018/19.

Those who are still terrified should ask themselves: do I personally know anyone who has died from the coronavirus?

So why the utter panic in the West? Why the shutting down of everyday life in the UK?

Boris using coronavirus

I personally think that there are multiple reasons in the UK:

Firstly, this Government doesn’t want to be seen not to be taking the threat seriously. It certainly doesn’t want to be blamed for austerity-related lack of NHS resources (nurses, hospital beds, respirators) to cope with the extra strain put on an underfunded health service.

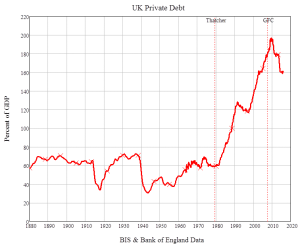

Secondly, the economy both here, (as in the US and EU) was in trouble before coronavirus. The Government would most likely have had to create billions of pounds to support the economy in the months ahead and stave off a deflationary spiral. The coronavirus has hastened that process. Moreover, it offers a perfect opportunity to kill 2 birds with a big bazooka of money. If the result is economic growth and inflation that shrinks our already debt burden, that is a perfect outcome.

Boris Johnson has cleverly decided to turn what could have been a PR disaster (public at risk from underfunded NHS, pollution and inadequate social care for the elderly) into an opportunity. He is using this pandemic scare and the fears of the population to try to unite a divided country, bail out failing businesses and a weak economy and secure the mantle of Churchill, something he has long craved.

Now I’m not saying that Coronavirus isn’t real. What I am saying that the health emergency we face is a direct result of underfunding of the National Health Service. Also, the economy and stock market was likely to crash very soon anyway, Coronavirus just acted as a catalyst to hasten the process.

Of course, most of the mainstream media is happy to go along with this charade. Just as they failed to acknowledge how weak the UK economy was before Coronavirus occurred, they want the British public to act herd-like and follow the current orthodoxy.

Soon, we’ll read in our press and the BBC and ITV how Boris saved the country from Coronavirus with his extreme measures and rescued the economy. Readers, you need to dig a little deeper and understand how you are being manipulated.

Be in no doubt, there will be a reckoning. When the UK public wakes up and realises it has been had, it won’t be happy. Then again, aided by the servile and unquestioning British media Boris Johnson may very well get away with it. At least until some historian comes to examine the facts many years from now.